Answer:

$81,301.80

This is the yearly reveneus required to break even the project at 15% return

Step-by-step explanation:

We need to solve for the equivalent annual cost to break-even financially at 15%

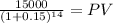

PV of the salvage value

Maturity $15,000.00

time 14.00

rate 0.15000

PV 2,119.9299

list price: 250,000 - quota: 2,119.93 = 247,880.07

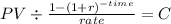

Now we solve for the equivallent annuity payment for this:

PV 247,880.07

time 14

rate 0.15

C $ 43,301.795

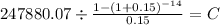

Now, we add up the maintenance cost:

43,301.80 + 38,000 = 81,301.8

This is the yearly reveneus required to break even the project at 15% return