Answer:

Goal: maximize return at the end of the fourth year.

Future value of each option:

First choise: $ 11,730,289.64

Second choise: $ 12,559,457.84

Conclusion:

It is better to pick the second option as yields a better return

Step-by-step explanation:

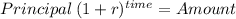

We solve for the future value of the cashflow of each option:

First choise:

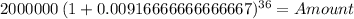

End of the first year:

Principal 2,000,000.00

time 36.00 (form end of the first to end of the fourth)

rate 0.00917 (11% / 12 months as it compounds monthly)

Amount $2,777,757.26

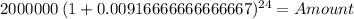

End of the second year:

Principal 2,000,000.00

time 24.00

rate 0.00917

Amount $2,489,657.04

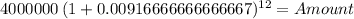

End of the third year:

Principal 4,000,000.00

time 12.00

rate 0.00917

Amount $4,462,875.34

End of the fourth year: $2,000,000

Total:

$2,777,757.26

$2,489,657.04

$4,462,875.34

$2,000,000

$ 11,730,289.64

Second choise:

First year

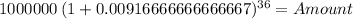

Principal 1,000,000.00

time 36.00

rate 0.00917

Amount 1,388,878.63

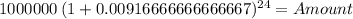

Second year:

Principal 1,000,000.00

time 24.00

rate 0.00917

Amount 1,244,828.52

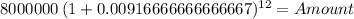

Third Year

Principal 8,000,000.00

time 12.00

rate 0.00917

Amount 8,925,750.69

Fourth year: 1,000,000

Total

1,388,878.63

1,244,828.52

8,925,750.69

1,000,000.00

12,559,457.84