There is a missing content in the question.

After the statements and before the the options given; there is an omitted content which says:

Referring to Table 16-5, in testing the coefficient of X in the regression equation (0.117) the results were a t-statistic of 9.08 and an associated p-value of 0.0000. Which of the following is the best interpretation of this result?

Answer:

C. The quarterly growth rate in the number of contracts is significantly different from 0% (? = 0.05).

Explanation:

From the given question:

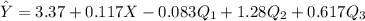

The resulting regression equation can be represented as:

where;

the estimated number of contracts in a quarter X is the coded quarterly value with X = 0

the first quarter of 2010 Q1 is a dummy variable equal to 1 in the first quarter of a year and 0 otherwise

Q2 is a dummy variable equal to 1 in the second quarter of a year and 0 otherwise

Q3 is a dummy variable equal to 1 in the third quarter of a year and 0 otherwise

Our null and alternative hypothesis can be stated as;

Null hypothesis :

The quarterly growth rate in the number of contracts is not significantly different from 0% (? = 0.05)

The quarterly growth rate in the number of contracts is not significantly different from 0% (? = 0.05)

The quarterly growth rate in the number of contracts is significantly different from 0% (? = 0.05)

The quarterly growth rate in the number of contracts is significantly different from 0% (? = 0.05)

The decision rule is to reject the null hypothesis if the p-value is less than 0.05.

From the missing omitted part we added above; we can see that the t-statistics value = 9.08 and the p-value = 0.000 .

Conclusion:

Thus; we reject the null hypothesis and accept the alternative hypothesis. i.e

The quarterly growth rate in the number of contracts is significantly different from 0% (? = 0.05)