Answer:

The quarterly growth rate in revenues is significantly different from 1.2%.

b. 2,666,858

Explanation:

Given that:

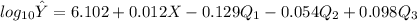

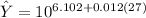

The regression equation can be represented as :

In testing the significance of the coefficient of X in the regression equation (0.012) which has a p-value of 0.02.

The null and alternative hypothesis can be stated as;

The quarterly growth rate in revenues is not significantly different from 1.2%.

The quarterly growth rate in revenues is not significantly different from 1.2%.

The quarterly growth rate in revenues is significantly different from 1.2%.

The quarterly growth rate in revenues is significantly different from 1.2%.

The decision rule is to reject the null hypothesis if the p-value is less than 0.05.

From above ; the p-value = 0.02 which is less than 0.05.

Conclusion:

Thus; we reject the null hypothesis and accept the alternative hypothesis. i.e

The quarterly growth rate in revenues is significantly different from 1.2%.

b.

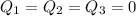

Since

; X = 27

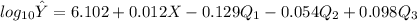

; X = 27

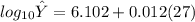

Thus ;

2666858.665

2666858.665

2,666,858

2,666,858