Answer:

It will need $ 107,120.321 dolalr per year to achieve his retirement goal

Step-by-step explanation:

We first must calcualte the prsent value of the 25 payments with equal worth of 60,000 dollar of today.

First we move the 60,000 forward 10 years

Principal 60,000.00

time 10.00

rate 0.05000

Amount 97,733.68

Now, we calculate the present value of an annuity considering this 5% inflation

g 0.05

r 0.08

C 97,734

n 25

$ 1,778,492.341

Then, decrease this by the amounnt already saved by our father:

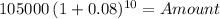

Principal 105,000.00

time 10.00

rate 0.08000

Amount 226,687.12

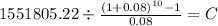

Additional saving needed:

1,778.492-34 - 226,687.12 = 1.551.805,22

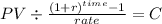

Now, we solve the annual saving to achieve this future value:

PV 1,551,805.22

time 10

rate 0.08

C $ 107,120.321