Answer:

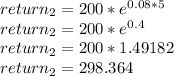

She should choose the Simply Savings Bank, since she'll earn around 2 dollars more in comparison to the other bank.

Explanation:

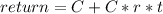

A simple interest rate account yields a return that follows the formula below:

Where C is the invested money, r is the interest rate and t is the elapsed time in years.

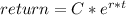

While a compound interest rate account yields a return that follows the formula below:

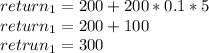

Therefore for the Simply Saving Bank she'll earn:

While the Capital Bank she'll earn:

She should choose the Simply Savings Bank, since she'll earn around 2 dollars more in comparison to the other bank.