Answer:

financing 62,400 dollars

Monthly Payment $ 465.48

Total Interest 21,386.4

Rounding to nearest $ 100

Additional $$ 34.52

We save up to 16 payments and $2,136.4 in interest.

By-weekly payment $232.60

Total Interest saved $ 194.4

Step-by-step explanation:

78,000 less 20% down-payment: 62,400

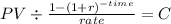

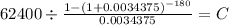

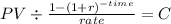

Monthly Payment

PV $62,400.00

time 180

rate 0.0034375

C $ 465.484

Total Interest

quota times time less principal

$ 465.48 x 180 - 62,400 = 21,386.4

$ 500 - $ 465.48 = $ 34.52

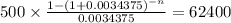

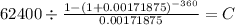

C $500.00

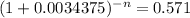

time n

rate 0.0034375

PV $62,400.0000

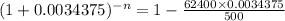

We now use logaritmics properties to solve for n

![-n= \frac{log0.571}{log(1+0.0034375)]()

-163.2956066

180 - 164 = 16 payments

Total Interst 500 x 163.30 - 62,400 = 19,250

Interest savings 21,386.4 - 19,250 = 2,136.4

If payment are bi-weekly:

then payments will be:

PV $62,400.00

time 360

rate 0.00171875

C $ 232.598

And total Interest:

232.2 x 360 - 62,400 = 21,192

Difference 21,386.4 - 21,192 = $ 194.4