Answer:

The probability that Actuary Rahul examines fewer policies that Actuary Toby = 0.2857

Explanation:

It is said that Actuary Rahul examines a low risk policy

Probability of a low risk policy having a claim = 10% = 0.1

Actuary Toby examines high risk policy

Probability of a high risk policy having a claim = 20% = 0.2

Let the number of policies examined by actuary Rahul before he finds a claim and stop be n

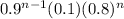

Probability that actuary Rahul examines exactly n policies =

Probability that Toby examines more than n policies =

Since the claim statuses of policies are mutually independent, the probability that both events happen simultaneously =

probability that both events happen simultaneously =

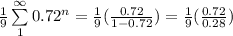

The probability that Actuary Rahul examines fewer policies that Actuary Toby =

=

=

The probability that Actuary Rahul examines fewer policies that Actuary Toby = 0.2857