Answer:

The Net Present Value = $451180.733

Explanation:

Given that:

the initial cost of the project is $1670000

the initial increase in working capital is $198000

The total investment will be ; initial cost of the project + initial increase in working capital

The total investment = $1670000 + $198000

The total investment = $1868000

So, This investment cost is amortised to zero over four years; This implies that the project will depreciate in four years;

Now; lets determine the rate of the annual depreciation

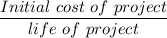

The annual depreciation =

The annual depreciation =

The annual depreciation = $417500

Over to the annual operating cash flow; the annual operating cash flow can be calculated as follows:

annual operating cash flow = (sales - cost) × (1 - tax rate )+ (annual depreciation × tax rate )

Given that the tax rate = 21% = 0.21

annual operating cash flow = (1850000 -1038000)×(1-0.21)+(417500× 0.21)

annual operating cash flow = 812000 × 0.79 + 87675

annual operating cash flow = 641480 + 87675

annual operating cash flow = $729155

So; let's calculate the after tax salvage value for the project

We know that the sales values for the project in four years is $435,000 (i.e the disposal rate of the asset after four years)

Thus; the book value is zero

The after tax salvage value for the project can now be determined by the relation:

after tax salvage value = sale value - tax (sale value - book value)

after tax salvage value = 435000 - 0.21 (435,000 -0)

after tax salvage value = 435000 - 91350

after tax salvage value = $343650

Similarly; given that the recovering rate of the project is $198000;

The cash flow in year 4 will be: annual operating cash flow + after tax salvage + recovery working capital

cash flow in year 4 = $(729155 + 343650 + 198000)

cash flow in year 4 = $ 1270805

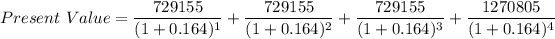

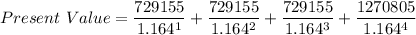

This implies that the cash flow from year one to three is : 729155

the cash flow in year four is : 1270805

Given that the Required return rate = 16.4% = 0.164

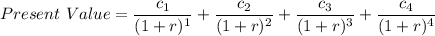

We can therefore determine the Present cash inflows by using the relation:

Present Value = $(626421.8213 + 538163.0767 + 462339.413+692256.4225)

Present Value = $2319180.733

Finally, The net present value = Present Value - Total Investment

Net Present Value = $(2319180.733 - 1868000)

Net Present Value = $451180.733

Therefore; The Net Present Value = $451180.733