Answer:

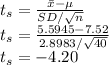

a) test statistic,

b) P-value = 0.0001

c) It can be concluded from the hypothesis that the company's stock has a mean value that is not 7.52 million shares i.e. the mean stock has changed in recent years

Explanation:

There are 40 trading days, therefore, sample size, n = 40

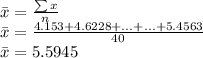

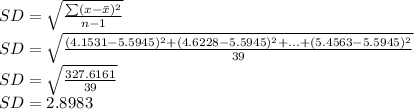

Calculate the Sample mean:

Get the null and alternative hypothesis:

Null hypothesis,

Alternative hypothesis,

Calculate the sample standard deviation:

a) Calculate the test statistic:

b) Calculate the P-value

Getting the P-value using the excel function:

P-value = (=T.DIST.2T(|ts|, df))

P-value = (=T.DIST.2T(4.20, 39))

P-value = 0.0001

c) If the level of significance,

The P-value (0.0001) < α(0.05), the null hypothesis is rejected.

It can therefore be concluded from the hypothesis that the company's stock has a mean value that is not 7.52 million shares i.e. the mean stock has changed in recent years