Answer:

1. q = 60 million doses

2. 360 millions

Step-by-step explanation:

Given that:

The cost function C(q) = 5,000 + 0.1q²

Then, the Marginal cost MC =

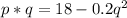

Again, inverse demand curve p(q) = 18 - 0.2 q

Then the total revenue TR =

Also; the marginal revenue MR =

= 18 - 0.1q

In the bid to maximize profits from BBG; MR = MC

i.e

18 - 0.1 q = 0.2 q

0.3 q = 18

q = 18/0.3

q = 60 million doses

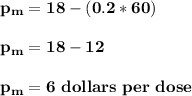

At the profit maximizing output, the price charged will be equal to :

Thus; producer surplus of Olderna at the monopoly price and quantity = price × quantity

= $6 × 60 millions

= 360 millions