Answer:

Step-by-step explanation:

Expected return of the portfolio is weighted average of the return of the components.

E(R) = w1 * R1 + w2 * R2

E(R) = 65% * 18% + 35% * 6%

E(R) = 11.70% + 2.10%

Expected Return, E(R) = 13.80%

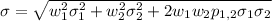

Standard deviation of portfolio is mathematically represented as:

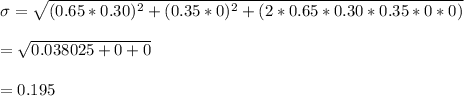

where

w1 = the proportion of the portfolio invested in Asset 1

w2 = the proportion of the portfolio invested in Asset 2

σ1 = Asset 1 standard deviation of return

σ2 = Asset 2 standard deviation of return

For risk free money market fund, standard deviation = 0 and its correlation with risky portfolio = 0

Standard deviation = 19.50%