Answer:

$7,560,000

Step-by-step explanation:

To solve this problem, the Present Value (PV) of a growing annuity formula is used.

The Present Value of a growing annuity is the current value of a series of payments which grows or diminishes at a constant rate each period.

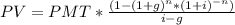

The formula below represents the PV of a growing annuity:

, ............................................. (i)

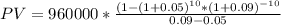

, ............................................. (i)

where,

PV = Present Value = ?

PMT = Periodic Payment = $960,000

i = Interest Rate = 9% = 0.09

g = Growth Rate = 5% = 0.05

n = Number of periods = 10 years

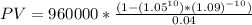

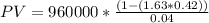

Substituting these values in equation (i), we have

PV = $7,560,000