Answer:

The present Value of Annual Gain for two years made from unwrapping the original swap agreement is $20.00

Step-by-step explanation:

From the given information;

The annual gain from swap agreements = $61.50 - $51.25

The annual gain from swap agreements = $10.25

Annual rate for the first year = 1% = 0.01

Annual rate for the second year = 2% = 0.02

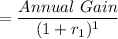

However the present gain for the first year will be;

= 10.14851485

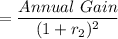

The present gain for the second year will be;

= 9.851980008

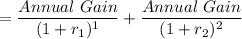

The present Value of Annual Gain for two years is:

= 10.14851485 + 9.851980008

= 20.00049486

≅ $ 20.00

The present Value of Annual Gain for two years is $20.00