Answer:

Explanation:

for n ∈ N

Since Actuary Rahul examines low-risk policies, continuing until a policy with a claim is found and then stopping.

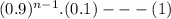

∴ the probability that Actuary Rahul examines exactly n policies

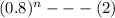

the probability that Actuary Toby examines more than exactly n policies

Given that policies are actually independent

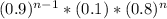

∴ the probability that the event (1) and (2) happens simultaneously is

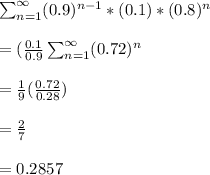

∴ the probability that Actuary Rahul examines fewer policies than Actuary Toby

the probability that Actuary Rahul examines fewer policies than Actuary Toby is 0.2857