Answer:

a) The null and alternative hypothesis are:

b) The 95% confidence interval for the mean stocks traded in 2014 in millions is (21.13, 29.07).

c) D. Reject the null hypothesis because μ= 35 1 million shares does not fall in the confidence interval.

Explanation:

The claim is that 2014 stock volumes are significantly different from 2011 stock volumes (35.1 millions).

Then, the null and alternative hypothesis are:

We can test this by calculating a 95% confidence interval for the mean.

The population standard deviation is not known, so we have to estimate it from the sample standard deviation and use a t-students distribution to calculate the critical value.

The sample mean is M=25.1.

The sample size is N=40.

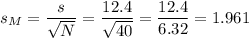

When σ is not known, s divided by the square root of N is used as an estimate of σM:

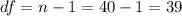

The degrees of freedom for this sample size are:

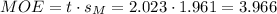

The t-value for a 95% confidence interval and 39 degrees of freedom is t=2.023.

The margin of error (MOE) can be calculated as:

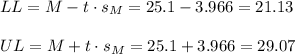

Then, the lower and upper bounds of the confidence interval are:

The 95% confidence interval for the mean is (21.13, 29.07).

The value 35.1 is not included in the interval, so we can conclude that there is significant difference from the 2011 stock volume.