Answer:

$45,800

Step-by-step explanation:

Given that: the cost of the equipment = $762000

We can determine the accumulated depreciation as follows:

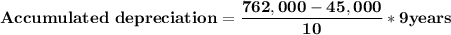

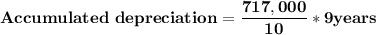

Accumulated depreciation= ((cost of equipment - salvage value )/useful lifetime )×Depreciation from 2012 to 2020

$ 645,300

$ 645,300

The Book value of equipment as on December 31,2020 = cost of equipment - accumulated depreciation

= $762,000 - $645,300

= $ 116,700

Also; the sale value = $162500

The gain to be recognize = $162,500 - $ 116,700 = $45,800