Answer:

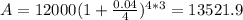

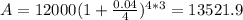

And n=4 since the rate is compounded quarterly, so then replacing this info we got:

So then Mario will have about $13521.9 after the 3 years with the rate of interest used.

Explanation:

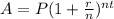

For this case we can use the formula for future value based on a compound interest given by:

Where A represent the future value, P the present value or the inversion r is the rate of interest on fraction, n the number of times that the rate of interest is compounded in a year and t the number of years.

For this case we know this:

And n=4 since the rate is compounded quarterly, so then replacing this info we got:

So then Mario will have about $13521.9 after the 3 years with the rate of interest used.