Answer:

The answer is "1.1"

Step-by-step explanation:

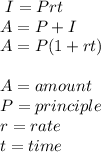

In the case of a single Interest, the principal value is determined as follows:

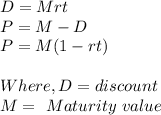

In case of discount:

Let income amount = 100, time = 1.5 years, and rate =20 %.

Formula:

A = P(1+rt)

A =P+I

by putting vale in the above formula we get the value that is = 76.92, thus method A will give 76.92 value.

If we calculate discount then the formula is:

P = M(1-rt)

M = 100 rate and time is same as above.

Thus Method B will give the value that is 70

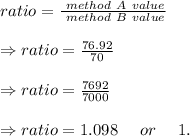

calculating ratio value: