Answer:

$10

Step-by-step explanation:

We are to account for external costs in production, since we are asked to find optimal tax.

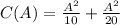

Given:

We now have:

A represents number of aluminum units produced, let's find A, since the margnal cost is $30.

Thus,

Let's equate the private marginal cost with the marginal revenue of each unit in order to achieve this amount of produced units with tax, t.

We have:

Substituting 100 for A above, we have:

30 - t = 20

t = 30 - 20

t = 10

Therefore, the socially optimal tax on aluminum is $10 per unit