Answer:

The times interest earned ratio is 4.42

Step-by-step explanation:

Interest expense = Bonds payable x Interest rate

= 1,306,531 x 10%

= $130,653

Times interest earned ratio = ( Income before income tax for year + Interest expense)/Interest expense

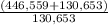

=

=

= 4.42