Answer:

The cost of preferred stock is 4.93 percent.

Step-by-step explanation:

Annual dividend = $2.65

Selling price of preferred stock = $57

The cost of selling cost = $3.30

Given firm’s tax rate = 21%

The tax rate will not be considered in the calculation of preferred stock’s cost because divident is not taxable in the case of preferred stock.

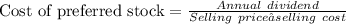

Now calculate the after tax cost of preferred stock: