Answer:

Step-by-step explanation:

This acts as more of a discount price for such an estimation of such a fixed present price of a company. It is often used to analyze investments when it is supposed to measure the opportunity price of the company. It is then used by corporations as the obstacle limit.

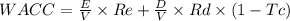

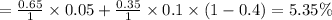

Let the total cost of equity to be Re = 5% = 0.05.

Let the market value to be E = 65% = 0.65.

Let V to the total market cost that combined debt and equity = 1 .

Let the total price of debt to Rd = 10% = 0.1.

Let the debt to be D = 35% = 0.35.

Let the income tax rate to be Tc = 40% = 0.4.