Answer:

The current share price will be "$106.70".

Step-by-step explanation:

Given over the stock of Johnson Inc,

Expected dividends averaging 4 years,

D1 = $7

D2 = $13

D3 = $18

D4 = $3.25

Rate of growing, g = 5%

Return required, rs = 8.4%

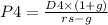

Thus, stock value for year four using just a constant dividend growth framework has been:

⇒

on putting the values in the above formula, we get

⇒

⇒

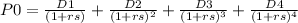

The current share price would seem to be a total amount of PV of future dividends as well as a discount of P4 at rs:

⇒

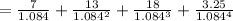

On putting values, we get

⇒

⇒