Answer:

The answer is "$84,000 in the numerator and 60,000 in the denominator".

Step-by-step explanation:

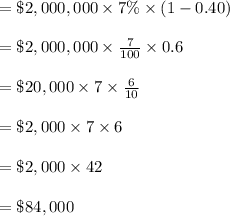

If securities are transformed into stocks. So, the common stack holder should be have a larger net revenue, calculation of net revenue

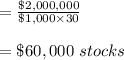

In addition, the loads will also raise the total amount of shares which is calculated as follows:

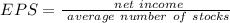

Formula:

That's why in this question numerator is = $ 84, 000 and denominator = $ 60,000