Answer:

New issued debt will be "$55.44 million". The further explanation is given below.

Step-by-step explanation:

As debt interest reduces equity grows:

Present equity's value will be:

=

= $

Debt's current value will be:

=

=

Now,

New share price =

=

=

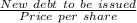

Value of new issued debt will be:

= $

Purchased shares will be:

=

=

= $