Answer:

The answers are $20,000 and $17,500.

Step-by-step explanation:

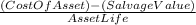

Straight Line Depreciation is a calculation made to find the amount that an asset's value has reduced over a certain period of time.

The formula for it is

.

.

The cost of the asset is $200,000 but for the first year there are also the freight, wiring and installation costs which apply just once and they come up to $25,000 in total.

So the depreciation for year one is going to be

which is $20000.

which is $20000.

The depreciation for year two is going to be

which is $17,500.

which is $17,500.

I hope this answer helps.