Answer:

The answer is "11.11"

Step-by-step explanation:

Given values:

The chances of increasing value by 50% is = 116

The chances of decreasing value by 50% is = 84

So, the two possible stock prices are:

S+ = 116 and S- = 84

The exercise price is = 100 so, possible called value are

Chance of increase (Ci) = 116-100 = 16

Chance of decrease (Cd)= 84 -100 = -16 it is - value that's why we avoid this so it equal to 0.

Formula:

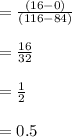

edge ratio =

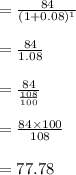

To develop a risk-free makes the image of one stock share and dual calling in paper. The actual cost of risk-free image is = exercise price- 2C0

= 100 -2C0

= 84 after some years.

The given value is = 84

time = 1 year

interest rate= 8%

interest:

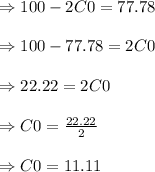

if the edged position is equivalent to the actual payout cost: