Answer:

The correct answer to the following question will be "8%".

Step-by-step explanation:

The given values are:

Number of years of maturity = 5 years

Interest rate of coupon = 10%

= 10%×1000

= 100

Yield to maturity, YTM = 8%

As we know,

Price of Bond = PV of Coupons + PV of Per Value

On putting the values in the above formula, we get

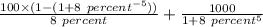

⇒ =

⇒ =

After 1 years, we get

Price of Bond = PV of Coupons + PV of Per Value

On putting the values in the above formula, we get

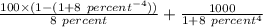

⇒ =

⇒ =

Now,

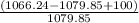

The total return rate =

=

=