Answer:

The correct answer to the following question will be "$76,986".

Step-by-step explanation:

Although the organization is reportedly going to pay $14.00 per unit, even before manufactured throughout the corporation, cost and save per unit will become the variation among current value as well as production costs without set rate. The cost of operating expenses will not be included to measure the gain because the idle resources of the company would be included and would not raise the fixed costs.

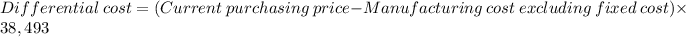

Therefore the cost differential would be as follows:

⇒

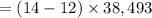

On putting the values in the above formula, we get

On putting the values in the above formula, we get

⇒

⇒

⇒