Answer:

The correct answer to the following question will be "$5427".

Step-by-step explanation:

The given expenditures are:

Temporary director's as well as organisational meetings expenditures = $8000

Fee payable to either the incorporation province = $2000

Incident accountants for organisation = $3500

Legal resources and by-laws for writing the company charter = $4300

So that total qualifying expenses will be :

⇒ $17,800

Now,

Deduction regarding section 248 election:

Immediate expensing = $5000

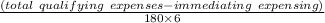

Amortization =

On putting the values in the above formula, we get

⇒ =

⇒ = $

Hence the deduction on election regarding section 248 = $5,427