Answer:

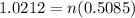

The number of years it would take is

Explanation:

From the question we are told that

The earning per share is

$3.50

$3.50

The growth rate is r = 7.0%

The duration is

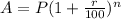

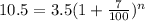

Generally the future value is mathematically represented as

Where P is the present value

n is the time period

A is the future value which is mathematically evaluated as

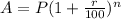

substituting value

$ 10.5 0

$ 10.5 0

So

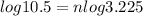

Taking log of both sides