Answer:

Profit is equal to $7000

Expected profit is equal to $1500

Step-by-step explanation:

Number of shares = 1000

Undervalued amount = $11

Overvalued amount = $4

Profit received by both the stocks is equal to

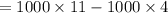

Profit = shares ×undervalued amount - shares × overvalued amount

=$7000

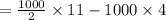

Expected profit is equal to

= $1500