Answer:

9% fund: $ 210,000

13% fund: $70,000

Explanation:

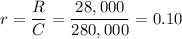

As she wants to have a $28,000 annual return for her $280,000 investment, she is expecting a return rate of 10%:

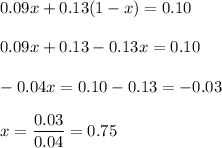

If we call x the proportion of the capital in the 9% fund, then (1-x) is the proportion of the capital in the 13% fund,and the return of the combination has to be the expected return of 10%:

Then, we know that 75% of the capital should be invested in the 9% fund and 25% in the 13% fund.

This correspond to a capital of:

9% fund: 0.75*$280,000 = $ 210,000

13% fund: 0.25*$280,000 = $70,000