Answer:

Payments for $ 1,820.971 /monthly are needed to cancel the loan after 25 years.

Step-by-step explanation:

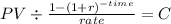

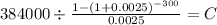

We need to solve for the monthly payment of a loan of 25 year with monthly payment:

PV 384,000.00

time 300 (25 years x 12 month per year)

rate 0.0025 (0.03 per year / 12 month )

C $ 1,820.971