Answer:

The correct answer to the following question will be "70.56".

Explanation:

The given values are:

Loan requires, PV = $100,000

Years = 20

Number of months, n = 240

Rate interest = 4.90000%

Monthly rate, r = 0.408333%

Monthly rental payment = $725

As we know,

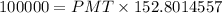

![PV=PMT* ((1)/(r))* [1-[(1)/((1+r)^n)]]](https://img.qammunity.org/2021/formulas/mathematics/middle-school/ugarvew9m077lqes4vta10mjls349ey8ev.png)

On putting the values in the above formula, we get

⇒

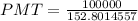

![100000=PMT* ((1)/(0.004083333))* [1-((1)/((1+0.004083333^(240))))]](https://img.qammunity.org/2021/formulas/mathematics/middle-school/ulbxb8zdlvkb8vmjfs7dr1u1luouyf79v9.png)

⇒

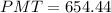

⇒

⇒

Now,

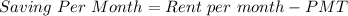

On putting the values, we get

⇒

⇒