Answer:

a) 123 cars will breakeven the project.

Step-by-step explanation:

We need to solve for the equivalent annual cost of the equipment and then, solve for the car to achieve a finnancial break-even:

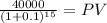

Salvage value present value

Maturity $40,000.00

time 15.00

rate 0.10000

PV 9,575.6820

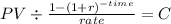

Present value of the Equipment

400,000 - 9,576 = 390,424

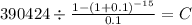

Equivalent annual cost:

PV 390,424.00

time 15

rate 0.1

C $ 51,330.518

Each car generates 720 of reveneu with a cost of 300 dollar the contribution is 420 per car

51,330 equivalent annual equipment cost

-----------------------------------------------------------------

420 contribution margin per car

break even = 122.12 = 123 cars