Answer:

after-tax cost of debt 5.2725%

Step-by-step explanation:

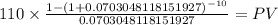

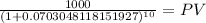

We will solve for the market rate of the bonds which is the one that makes the maturity and coupon payment equal to its current market price:

We sovle it using a financial calcualtor or excel goal seek tool

C 110.000 (1,000 x 11%)

time 10 years

rate 0.070304812

PV $771.5066

Maturity 1,000

time 10 years

rate 0.070304812

PV 506.90

PV c $771.5066

PV m $506.9034

Total $1,278.4100

Now that we find that market rate is 7.03%

we calcautle the after tax cost of debt:

7.03 x (1 - 25%) = 5.2725%