Answer:

Initial cost of the equipment = $339,600

Step-by-step explanation:

Given:

Yearly net cash inflow = $60,000

Salvage value = $0

Internal rate of return = 14% = 0.14

Required rate of return = 10%

Find:

Initial cost of the equipment = ?

Computation:

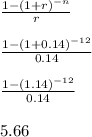

Annuity factor of internal rate of return

Initial cost of the equipment = Yearly net cash inflow × Annuity factor of internal rate of return

Initial cost of the equipment = $60,000 × 5.66

Initial cost of the equipment = $339,600