Answer:

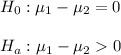

The null and alternative hypothesis are:

where μ1 is the annual expense for stock funds and μ2 is the annual expense for municipal bond funds.

There is enough evidence to support the claim that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds.

Explanation:

The question is incomplete:

Set up the null and alternative hypotheses needed to attempt to establish that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds. Test these hypotheses at the .05 level of significance.

This is a hypothesis test for the difference between populations means.

The claim is that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds.

Then, the null and alternative hypothesis are:

where μ1 is the annual expense for stock funds and μ2 is the annual expense for municipal bond funds.

The significance level is α=0.05.

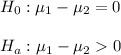

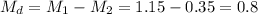

The sample 1, of size n1=25 has a mean of 1.15 and a standard deviation of 0.31.

The sample 2, of size n2=25 has a mean of 0.35 and a standard deviation of 0.15.

The difference between sample means is Md=0.8.

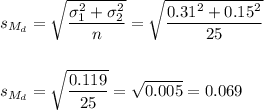

The estimated standard error of the difference between means is computed using the formula:

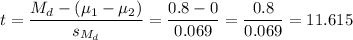

Then, we can calculate the t-statistic as:

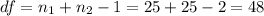

The degrees of freedom for this test are:

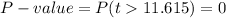

This test is a right-tailed test, with 48 degrees of freedom and t=11.615, so the P-value for this test is calculated as (using a t-table):

As the P-value (0) is smaller than the significance level (0.05), the effect is significant.

The null hypothesis is rejected.

There is enough evidence to support the claim that the mean annual expense for stock funds is larger than the mean annual expense for municipal bond funds.