Answer:

Option D

Explanation:

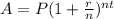

To calculate compound interest we will use the formula :

Where,

A = Amount on maturity

P = Principal amount = $3000

r = rate of interest = 8.4% = 0.084

n = number of compounding period = Monthly = 12

t = time = 1 year

Now put the values in the formula.

=

= 3000(1.007)¹²

= 3000 × 1.08731066

= 3261.93198 ≈ $3261.93

While the other bank compounds interest daily.

Therefore, n = 365

Now put the values in the formula with n = 365

= 3000 × 1.08761958

= 3262.85874 ≈ $3262.86

Difference in the ending balance = 3262.86 - 3261.93

= $0.93

The difference in the ending balances of both CDs after one year would be $0.93.