Answer:

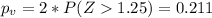

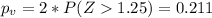

The p value for this case is given by:

Since the p value is higher than the significance level given of 0.1 or 10% we have enough evidence to FAIL to reject the null hypothesis and we can conclude that the two delinquency rates in the two neighborhood ar enot significantly different.

And is important to remark that if the delinquency rate is a big number the investor probably would overthink about the investment

Explanation:

Information given

represent the number of homes were seriously delinquent in neighborhood 1

represent the number of homes were seriously delinquent in neighborhood 1

represent the number of homes were seriously delinquent in neighborhood 2

represent the number of homes were seriously delinquent in neighborhood 2

sample 1 selected

sample 1 selected

sample 2 selected

sample 2 selected

represent the proportion estimated of homes were seriously delinquent in neighborhood 1

represent the proportion estimated of homes were seriously delinquent in neighborhood 1

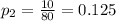

represent the proportion estimated of homes were seriously delinquent in neighborhood 1

represent the proportion estimated of homes were seriously delinquent in neighborhood 1

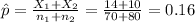

represent the pooled estimate of for the proportion p

represent the pooled estimate of for the proportion p

z would represent the statistic

represent the value for the test

represent the value for the test

significance level given

significance level given

System of hypothesis

We want to analyze if the two proportions for the delinquency rates are different , the system of hypothesis are:

Null hypothesis:

Alternative hypothesis:

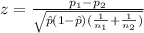

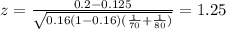

The statistic for this case is given by:

(1)

(1)

Where

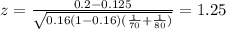

Now we can calculate the statistic:

The p value for this case is given by:

Since the p value is higher than the significance level given of 0.1 or 10% we have enough evidence to FAIL to reject the null hypothesis and we can conclude that the two delinquency rates in the two neighborhood ar enot significantly different.

And is important to remark that if the delinquency rate is a big number the investor probably would overthink about the investment