Answer:

No. There is not enough evidence to support the claim that the dividend yield of all Australian bank stocks is higher than 4.7%.

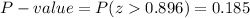

The P-value is 0.185.

Explanation:

This is a hypothesis test for the population mean.

The claim is that the dividend yield of all Australian bank stocks is higher than 4.7%.

Then, the null and alternative hypothesis are:

The significance level is assumed to be 0.05.

The sample has a size n=10.

The sample mean is M=5.38.

The standard deviation of the population is known and has a value of σ=2.4.

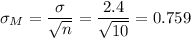

We can calculate the standard error as:

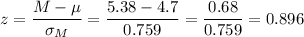

Then, we can calculate the z-statistic as:

This test is a right-tailed test, so the P-value for this test is calculated as:

As the P-value (0.185) is bigger than the significance level (0.05), the effect is not significant.

The null hypothesis failed to be rejected.

There is not enough evidence to support the claim that the dividend yield of all Australian bank stocks is higher than 4.7%.