Answer:

Check the explanation

Explanation:

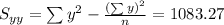

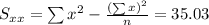

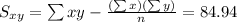

Following table shows the calculations:

Delta, X Southwest , Y X^2 Y^2 XY

45.96 38.76 2112.3216 1502.3376 1781.4096

46.8 45.41 2190.24 2062.0681 2125.188

47.93 15.7 2297.2849 246.49 752.501

51.78 49.58 2681.1684 2458.1764 2567.2524

52.17 44.34 2721.7089 1966.0356 2313.2178

47.36 18 2242.9696 324 852.48

Total 292 211.79 14245.6934 8559.1077 10392.0488

Sample size: n =6

Now

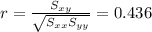

The coefficient of correlation is :