Answer:

The correct answer to the following question will be "$2.263 million".

Step-by-step explanation:

In such a floating rate bond, the swap may be viewed as a long positioning paired with such a short squeeze in some kind of a fixed price bond. An appropriate discount rate through quarterly compound growth is 12 percent per annum or 11.8 percent annually with continuous compounding.

The floating rate loan would be worth $100 million right during the next deposit.

The next floating part would be:

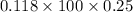

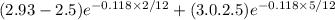

⇒

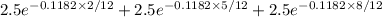

⇒

Therefore the floating rate value will be:

⇒

⇒

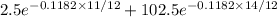

⇒

Now, Swap value:

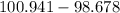

⇒

⇒ $

We should consider the swap as either a realistic approach to forward rate deals as just an alternative solution.

The estimated value is set to:

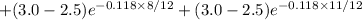

⇒

⇒

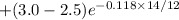

⇒

⇒ $