Answer:

The risk will be reduced by 0.109

Step-by-step explanation:

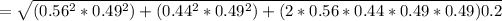

Standard deviation for stock A = 49%

Standard deviation for stock B = 49%

Correlation = 0.2

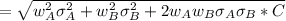

Let's use the standard deviation of portfolio equation:

Where

= 100% - 56% = 44%

= 100% - 56% = 44%

= 0.381 = 38.1%

The risk will be reduced by:

(0.56*0.49)+(0.44*0.49)-0.381

= 0.109