Answer:

The stock price at year end is $59.45

Step-by-step explanation:

Given that:

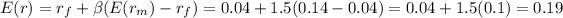

risk-free rate of interest (

)= 4% = 0.04,

)= 4% = 0.04,

expected rate of return on the market

= 14% = 0.14

= 14% = 0.14

Beta (

) = 1.5

) = 1.5

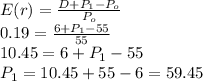

Dividends (D) = $6

Current price of stock

= $55

= $55

Therefore, the expected rate of return (

) is given as:

) is given as:

The price of the stock at the end of the year (

) is given as:

) is given as:

P₁ = $59.45