Answer:

3.3 years

Explanation:

Let the price of the house when it is being sold be = x

The Annual return received from the fund after a year that house is being sold is : A - P

where ;

P = current market price

A = price after one year

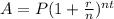

A is given by the formula:

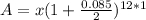

where ; P = x

r = 8.5% = 0.085

n = 12

t = 1

A = 1.08839 x

The annual return is A - P = 1.08839 x - x

= 0.08839x

However, the house should be sold when this return is equivalent to the annual increase in value of the house

∴ 0.08839x = 31250

Thus , the current price (x) = $353546.78

Profit till that time = Current price - Initial Price

= (353546.78- 250000)$

= $103546.78

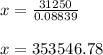

The time taken for this much profit to accumulate =

=

= 3.3135

≅ 3.3 years ( to one decimal place)