Answer:

WACC 7.05052%

Step-by-step explanation:

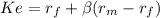

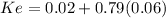

First, we solve for the cost of capital using CAPM:

risk free = 0.02

market rate = 0.08

premium market = (market rate - risk free) 0.06

beta(non diversifiable risk) = 0.79

Ke 0.06740

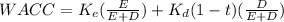

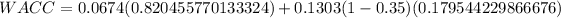

Then, we solve for the equity and debt weight using market value:

D 10,329

E 47,200

V 57,529

Equity weight = E/V = 0.8205

Debt Weight = D/V = 0.1795

Then, we can solve for the WACC:

WACC 7.05052%