Answer:

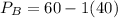

Market A:

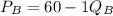

Market B:

Step-by-step explanation:

Market A:

........................ (1)

........................ (1)

Market B:

........................ (2)

........................ (2)

MC = m = 20 ............................................... (3) for both markets

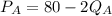

For Market A:

Profit maximizing price can be obtained when

Therefore, we have:

Substituting 50 for

in equation (1), we have:

in equation (1), we have:

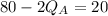

For Market B:

Profit maximizing price can be obtained when

Therefore, we have:

Substituting 80 for

in equation (2), we have:

in equation (2), we have: